Fundamentals of Taxation and Auditing | Mgt.218 | Question Paper | 2077-2021 | BBS Third Year | Download in PDF

DRG Vlogs https://www.dhanraj.com.np presents you the new question/exam paper of the subject Fundamentals of Taxation and Auditing Mgt.218 BBS Third Year 4 Years Program of the year 2077-2021 which was held on March 04, 2021 (Falgun 20, 2077).

Candidates are required to give their answers in their own words as far as practicable.

Also Check:

Download PDF Business Law | Mgt.204 | Question Paper | 2077-2021 | BBS Third Year.

Also Check:

Download PDF Fundamentals of Financial Management | Mgt.215 | Question Paper | 2077-2021 | BBS Third Year.

Also Check:

Download PDF Business Environment and Strategy | Mgt.217 | Question Paper | 2077-2021 | BBS Third Year.

Also Check:

Download PDF Organizational Behavior | Mgt.219 | Question Paper | 2077-2021 | BBS Third Year.

The figures in the margin indicate full marks.

Part I - Taxation

Brief Questions Answer. (5x2=10)

Attempt ALL questions.

1. What is direct tax? Give any three examples.

2. What do you know about "Cannon of equality"?

3. What are the provsions of carry forward of business loss under Income Tax Act, 2058?

4. Mr. Sharma has disclosed total income from a sole proprietorship business Rs. 10,00,000 before deducting donation paid to tax - exempt social organization Rs. 10,000. Compute tax liability for the current income year.

5. A trading company supplied the following information:

Beginning inventory of the raw materials Rs. 4,00,000, Purchases during the year Rs. 10,00,000, Carriage inward Rs. 50,000, Custom duty Rs. 20,000, Closing stock Rs. 70,000.

Required: Cost of trading stock.

Short Questions Answer. (4x10=40)

Attempt ALL questions.

6.

(a). Mr. Sumijo, a Japanese citizen, came to Nepal on 1st Kartik of previous income year and involve in business and investment activities. He submitted the statement with the following incomes:

↺ Income from handicraft business Rs. 5,00,000

↺ Gain from investment Rs. 2,00,000

↺ Remuneration on delivery of lecture in a work shop Rs. 20,000.

↺ He has paid donation to a social club Rs. 50,000.

Required:

i) Residential status with explanation.

ii) Statement of taxable income.

iii) Tax liability. (1+2+2)

(b). A product was passed from producer to wholesaler at Rs. 1,13,000 inclusive VAT. The wholesaler sold it to a retailer at Rs. 1,50,000 without VAT. The retailer sold it to a final customer charging profit 20 percent on cost price. The administrative expense incurred by the retailer was Rs. 2,000.

Required:

i) Cost price to the final customer.

ii) VAT payable to the government at different levels of selling. (2+3=5)

7.

(a). A company earned net income of Rs. 10,00,000 from trading business. The other details relating to it's net income are as following:

↺ Allowable depreciation of Rs. 35,000 has not been deducted,

↺ Miscellaneous income of Rs. 50,000 is not included in net income,

↺ Refund of income tax Rs. 15,000 is included in net income,

↺ Unrecovered business loss of last year Rs. 2,00,000 is not adjusted with net income.

Required:

Taxable income and tax liability. (4+1=5)

(b). Describe the provisions regarding depreciation as laid down under Income Tax Act, 2058. (5)

8. Mr. Thapa Magar has submitted the following incomes and expenditures for the previous income year:

↺ Rent of tents and furniture Rs. 5,00,000,

↺ Dividends from shares of commercial banks Rs. 95,000 (net)

↺ Interest from saving bank deposit Rs. 70,000,

↺ Royalty on copyright Rs. 1,70,000 (net),

↺ Rent of building let out Rs. 90,000,

↺ Interest on tax free government securities Rs.1,00,000,

↺ Refund of income tax on investment Rs. 18,000,

↺ Natural resource incomes Rs.2,55,000 (net),

↺ He claimed following expenses for deductions,

↺ Collection expenses for natural resource incomes Rs. 15,000,

↺ Interest on loan taken to purchase shares of commercial banks Rs.35,000,

↺ Repairing expenses of tents and furniture (with written down value of Rs.2,00,000) Rs.30,000,

↺ Donation to a community hospital Rs. 20,000.

Required:

Taxable Income from investment (10)

9. Mr. Gokul was appointed as an officer of Nepal Government on 1st Shrawan 2062 B.S. at the pay scale of Rs.36,000 - 1000 - 46,000 - 2,000 - 56,000. The other details of his income and expenditures of previous income year are given below:

↺ House ren allowance Rs.4,000 PM.

↺ Dearness allowance Rs. 2,000 PM.

↺ Meeting allowance Rs. 12,000.

↺ Children education allowance Rs.30,000.

↺ Local allowance Rs.2,000 PM.

↺ His telephone and electricity bills paid by office Rs.26,000.

↺ He received Dashain bonus and provident fund facilities as per Government regulation.

↺ Interest received from private borrowings, Rs.40,000,

↺ He claimed fuel expenses of private car Rs. 36,000 for deduction.

↺ He claimed PREMIUM Rs. 30,000 on his life insurance for deduction.

Required:

a) Assessable income from employment,

b) Statement of total taxable income,

c) Tax liability. (6+2+2=10)

Comprehensive Questions Answer. (2x15=30)

Attempt any TWO questions.

10.

(a). What are the duties of tax payers as per income Tax Act, 2058? (7)

(b). Briefly explain the different methods of tax collection as per income Tax Act, 2058. (8)

11.

(a). A trading company has supplied following particulars of it's fixed assets under block "B" for the current income year:

↺ Opening written down value Rs. 8,00,000.

↺ Purchase of office furniture Rs.3,00,000 on Chaitra,

↺ Purchase of office equipment Rs. 90,000, on Baisakh,

↺ Disposal of damaged furniture at Rs. 60,000,

↺ Actual cost incurred for repairing furniture during the year Rs. 75,000.

Required:

(a) Allowable amount of depreciation,

(b) Closing balance of depreciable value to the next year. (5+3=8)

11. (b). The operating results of a proprietorship business unit are as followings:

| Years: | 1 | 2 | 3 | 4 | 5 |

| Profit/loss | (3,00,000) | (5,00,000) | (4,00,000) | (6,00,000) | (7,00,000) |

On enquiry the following facts were found:

↺ In year 1, donation to a tax-exempt organization Rs. 20,000 was deducted from the income.

↺ In year 2, allowable depreciation of Rs. 50,000 was not deducted,

↺ In year 3, pollution control cost Rs. 30,000 was also deducted,

↺ In year 4, sales amount of old news papers and scrapes Rs. 25,000 was not included in the income.

Required:

Taxable income of the business unit showing carry-forward of business losses and necessary other adjustments with explanation. (7)

12. Mr. Pokhrel has submitted the following trading and profit and Loss A/C of his business for the previous income year:

Trading and profit and loss account:

| Particulars | Amount | Particulars | Amount |

|---|---|---|---|

| To opening stocks | 2,00,000 | By sales | 21,00,000 |

| To purchases | 8,00,000 | By closing stocks | 1,00,000 |

| To carriage inwards | 1,50,000 | ||

| To gross profit c/d | 10,50,000 | ||

| 22,00,000 | 22,00,000 | ||

| To salaries | 2,00,000 | By gross profit b/d | 10,50,000 |

| To general expenses | 50,000 | By bad debts recovered | 1,00,000 |

| To interest | 60,000 | By discount and commission | 50,000 |

| To rent | 40,000 | By dividends | 70,000 |

| By telephone and electricity | 30,000 | By interest on investment | 30,000 |

| To legal expenses | 20,000 | By various incomes | 75,000 |

| To depreciation of furniture | 50,000 | By incomes from natural resources (net) | 85,000 |

| To repairs of business premises | 20,000 | ||

| To donation to a school | 1,00,000 | ||

| To provision for doubtful debts | 70,000 | ||

| To advance income tax | 20,000 | ||

| To business research | 30,000 | ||

| To net profit | 7,70,000 | ||

| Total (Rs) | 14,60,000 | Total (Rs) | 14,60,000 |

Additional information:

↺ Legal expenses include Rs. 10,000 income tax appeal expenses.

↺ Repair expenses are related to the business premises having written down value of Rs.2,00,000.

↺ Interest includes the interest on non-business loan Rs. 40,000.

↺ 20 percent of bad debts recovered is the recovery of bad debt which was not allowed for deduction in former assessment.

↺ Various incomes include Rs. 10,000 refund of income tax.

↺ Mr. Pokhrel paid premium for his life insurance Rs. 30,000.

↺ General expenses include Rs. 8,000 as the collection expenses of dividends.

Required:

(a) Assessable Income from Business.

(b) Assessable Income from Investment.

(c) Statement of Total Taxable Income. (10+2+3=15)

Part II - Auditing

Brief Questions Answer. (5x2=10)

Attempt ALL questions.

13. What is auditing?

14. What are compensating errors?

15. What do you know about internal check?

16. Write down the meaning of "Teeming and Lading".

17. State with appropriate reasons whether the following are errors or frauds?

a) Over-casting payment side of cashbook.

b) Recording fictitious purchases.

c) Omitting entry of miscellaneous income in P/L A/C.

d) Showing credit purchases as cash purchases.

Short Questions Answer. (1x10=10)

Attempt any ONE question.

18.

(a) What is vouching? Why is it an important step of auditing process. (5)

(b) Describe different types of audit report. (5)

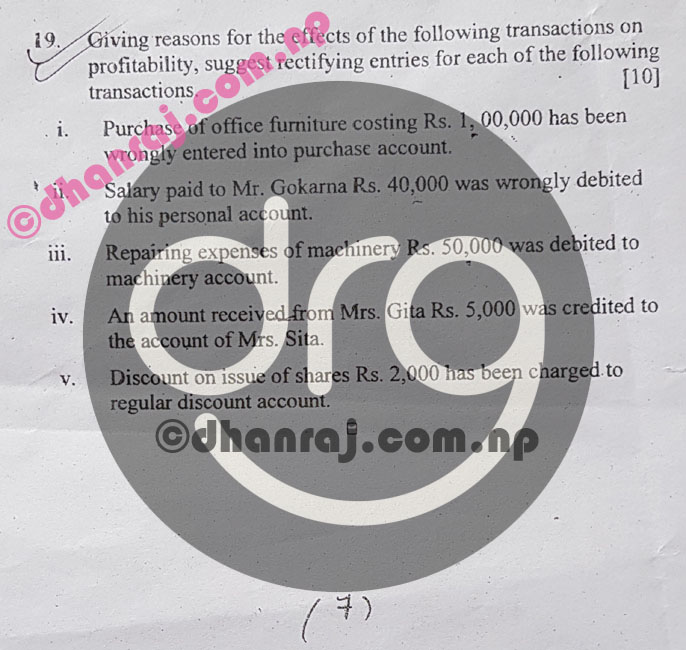

19. Giving reasons for the effects of the following transactions on profitability, suggest rectifying enteries for each of the following transactions. (100

i. Purchase of office furniture costing Rs. 1,00,000 has been wrongly entered into purchase account.

ii. Slaray paid to Mr. Gokarna Rs. 40,000 was wrongly debited to his personal account.

iii. Repairing expenses of machinery Rs. 50,000 was debited to machinery account.

iv. An amount received from Mrs. Gita Rs. 5,000 was credited to the account of Mrs. Sita.

v. Discount on issue of shares Rs. 2,000 has been charged to regular discount account.

[alert type=alert_outline alert_info]Note:- If you need 2077/2021 Fundamentals of Taxation and Auditing (Mgt.218) BBS III Third Year Question Paper in PDF file, please post your email address in "Comment Box" below. :)[/alert]

[alert type=alert_outline alert_info]View the Question Paper of BBS III Third Year Fundamentals of Taxation and Auditing (Mgt218) Question Paper of the year 2077-2021.[/alert]

[button href=https://www.dhanraj.com.np/ style=outlined elcreative_ripple]Search Terms:[/button]

[alert type=alert_info]Tribhuvan University (TU)., Fundamentals of Taxation and Auditing Mgt.218., Fundamentals of Taxation and Auditing Mgt.218. Question Paper 2077-2021 BBS Third Year Download in PDF., Bachelor Of Business Studies (BBS) III Third Year Question Papers 2077-2021., Exam Papers of BBS 4 Years Program III Third Year Management MGMT 2077., TU BBS 4 Years Program III Third Year MGMT 2077 Question Papers 2077-2021., BBS Mgmt III Third Year Question Papers 2077-2021 MGT-219., Question Paper of Fundamentals of Taxation and Auditing Mgt.218., Check Question Paper of Fundamentals of Taxation and Auditing Mgt.218. Question Paper of the year 2077., PDF Download Of Fundamentals of Taxation and Auditing Mgt.218. of year 2077-2021., Check & Download Fundamentals of Taxation and Auditing Mgt.218 Exam Paper of year 2021-2077., Solution Of Question Paper Fundamentals of Taxation and Auditing Mgt.218. of 2077., Exam Papers of 2077-2021 BBS III Third Year Fundamentals of Taxation and Auditing Mgt.218., Download 2077 Question Paper of Fundamentals of Taxation and Auditing Mgt.218.[/alert]

Suggestions and/or questions are always welcome, either post them in the comment form or send me an email at drgurung82@gmail.com.

However, comments are always reviewed and it may take some time to appear. Always keep in mind "URL without nofollow tag" will consider as a spam. 😜