Fundamentals of Corporate Finance (FIN-250) | IV Year | MGMT | Question Paper 2077 | BBS (4 Yrs. Prog.) | TU

Fundamentals of Corporate Finance (FIN-250) IV Year Question Paper 2077 BBS (4 Yrs. Prog.) Tribhuvan University (TU).

Candidates are required to give their answers in their own words as far as practicable.

The figures in the margin indicate full marks.

Also Check:

Download PDF - Business Research Methods (MGT-221) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year.

Download PDF - Business Research Methods (MGT-221) | IV Year | Question Paper 2077 | BBS (4 Yrs. Prog.) | TU.

Download PDF - Fundamentals of Investment (FIN-253) | IV Year | Question Paper 2077-2020 | BBS (4 Yrs. Prog.) | TU.

Download PDF - Fundamentals of Corporate Finance (FIN-250) | IV Year | MGMT | Question Paper 2077 | BBS (4 Yrs. Prog.) | TU.

Group "A"

Brief Answer Questions:

Attempt ALL the questions. [10x2=20]

Also Check:

Download PDF of Fundamentals of Corporate Finance (FIN-250) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year.

1. Why should the financial manager work together with other functional managers?

2. What do you mean by agency problem between shareholders and creditors?

3. How does the goal of stock price maximization benefit the society?

4. Distinguish between primary market and secondary market.

5. State the major types of financial institution in Nepal.

6. Write the meaning of financial derivatives.

7. Assume 3-months US T-bills have a nominal rate of 8 percent, while default free European bond that mature in 3 months have a nominal rate of 6 percent. In the spot exchange market, one Euro equals $1.15. If interest rate parity holds. What is the 6-months forward exchange rate?

8. Suppose you have purchased a call option of Unilever Limited. Each call option entitles you to purchase one stock of the company at a price of Rs. 1200. The option premium for one call option is Rs. 30. The expiration period of the option is 3 months. If the stock price of the company becomes Rs. 1500 at the expiration date. Calculate value of call option.

9. Hari is interested in buying a motor bike. He is applying for Rs. 125,000, 3 years loan. The loan will be fully authorized over the next 3 years. Current interest rate is 12 percent. How much should be paid by Hari for the yearly installment of loan?

10. Dabur Nepal wishes to borrow Rs. 10,000 for one year from NBL. The annual interest rate of the loan is 10 percent. The interest is paid on a discount basis and 10 percent compensating balance is required. What is the effective interest rate for the Dabur Nepal?

Group ''B''

Descriptive Answer Questions. (5x10=50)

Attempt FIVE questions.

11. Why preferred stock is hybrid form of long-term financing? Describe the merits and demerits of preferred stock financing. (4+6=10)

12. What do you mean by mergers and acquisitions? Discuss the significance of mergers and acquisition in Nepal. (5+5=10)

13. Suppose the inflation rate is expected to be 7% next year, 5% the following year, and 3% thereafter. Assume that the real risk-free rate will remain at 2% and that maturity risk premium on Treasury securities rise from zero on very short-term bonds (those that mature in a few days) to 0.2% for 1-year securities. Furthermore, maturity risk premium increase 0.2% for each year maturity, up to a limit of 1.0% on 5-years or longer term T-bonds.

a) Calculate the average expected inflation rate for 1-, 2-, 3-, 4-, 5- and 10- year treasury securities.

b) Calculate the maturity risk premium for 1-, 2-, 3-, 4-, 5- and 10- years Treasury securities.

c) Calculate the interest rate on 1-, 2-, 3-, 4-, 5-, and 10- year treasury securities. (3+3+4=10)

14. David Baseball Bat Company currently has Rs. 3,000,000 in debt outstanding, bearing an interest rate of 12 percent. It wishes to finance a Rs. 4,000,000 million expansion program and is considering three alternatives: additional debt at 14 percent interest (option 1), preferred stock with a 12 percent dividend (option 2), and the sale of common stock at Rs. 100 per share (option 3). The company currently has 800,000 shares of common stock outstanding and is in a 40 percent tax bracket.

a) If earnings before interest and taxes are currently Rs. 1,500,000, what would be earnings per share for the three alternatives assuming no immediate increase in operating profit?

b) Determine the indifference point between the debt plan and the common stock plan. (6+4=10)

15. The most recent financial statements for Ramailo Tours Company are shown below:

| Income Statement for year ended December 31, 2016 | ||

|---|---|---|

| Sales | Rs. 845,000 | |

| Costs | (657,000) | |

| Other Expenses | 17,500 | |

| Earnings before interest and taxes | Rs. 176,000 | |

| Interest paid | (12,500) | |

| Taxable income | Rs. 158,000 | |

| Taxes (35%) | (55,500) | |

| Net income | Rs. 102,700 | |

| Dividends | Rs. 30,810 | |

| Addition to retained earnings | Rs. 71,890 | |

| Balance Sheet as of December 31, 2016 | |||

|---|---|---|---|

| Assets | Liabilities and Owners' equity | ||

| Current assets | Current liabilities | ||

| Cash | Rs. 23,000 | Accounts Payable | Rs. 62,000 |

| Receivables | Rs. 37,000 | Notes Payable | Rs. 15,000 |

| Inventory | Rs. 79,000 | Total Current Liabilities | Rs. 77,000 |

| Total current assets | Rs. 139,000 | Long-term debt | Rs. 144,000 |

| Fixed assets | Owners' equity | ||

| New plant and equipment | Rs. 375,000 | Common stock and paid-in surplus | Rs. 100,000 |

| Retained earnings | Rs. 193,000 | ||

| Total owners' equity | Rs. 293,000 | ||

| Total assets | Rs. 514,000 | Total liabilities and equity | Rs. 514,000 |

a) Assume that sales for 2017 are projected to grow by 20 percent. Interest expenses will remain constant: the tax rate and the dividend payout rate will also remain constant. Costs, other expenses, current assets and account payable increase spontaneously with sales. If the firm is operating at full capacity, what external financing is needed to support the 20 percent growth rate in sales?

b) Prepare pro forma balance sheet for the year ending 2017. Use AFN to balance the pro forma balance sheet. (6+4=10)

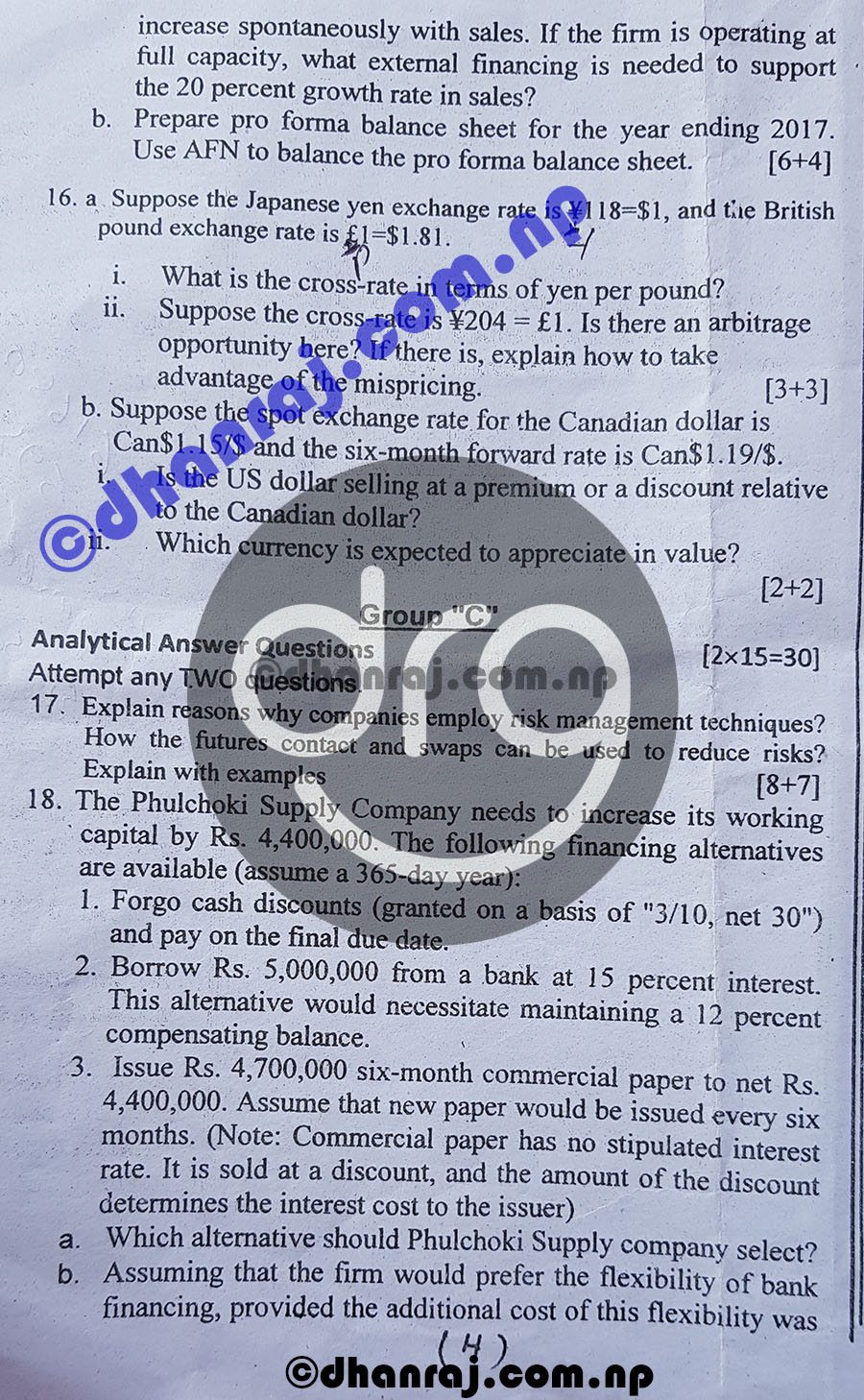

16.

a) Suppose the Japanese yen exchange rate is ¥118 = $1, and the British pound exchange rate is £1 = $1.81.

i. What is the cross-rate in terms of yen per pound?

ii. Suppose the cross-rate is ¥204 = £1. Is there an arbitrage opportunity here? If there is, explain how to take advantage of the mispricing. (3+3=6)

b) Suppose the spot exchange rate for the Canadian dollar is Can$1.15/$ and the six-months forward rate is Can$1.19/$.

i. Is the US dollar selling at a premium or a discount relative to the Canadian dollar?

Which currency is expected to appreciate in value? (2+2=4)

Group 'C'

Analytical Answer Questions:

Attempt any TWO questions. (2x15=30)

17. Explain reasons why companies employ risk management techniques? How the futures contact and swaps can be used to reduce risks? Explain with examples. (8+7=15)

18. The Phulchoki Supply Company needs to increase it's working capital by Rs. 4,400,000. The following financing alternatives are available (assume a 365-day year):

(1). Forgo cash discounts (granted on a basis of "3/10, net 30") and pay on the final due date.

(2). Borrow Rs. 5,000,000 from a bank at 15 percent interest. This alternative would necessitate maintaining a 12 percent compensating balance.

(3). Issue Rs. 4,700,000 six-months commercial paper to net Rs. 4,400,000. Assume that new paper would be issued every six months. (Note: Commercial paper has no stipulated interest rate. It is sold at a discount, and the amount of the discount determines the interest cost to the issuer)

a) Which alternative should Phulchoki Supply Company select?

b) Assuming that the firm would prefer the flexibility of bank financing, provided the additional cost of this flexibility was no more than 2 percent per annum which alternative should the company select?

c) Is the source with the lowest expected cost necessarily the source the select? Why or why not? (3x4+1.5+1.5=15)

19. Roal Shoe Co. has concluded that additional equity financing will be needed to expand operations and that the needed funds will be the best obtained through a rights offering. Presently there are 350,000 shares outstanding at Rs. 760 each. There will be 70,000 new shares offered at Rs. 700 each.

Required:

a) What are the advantages of rights offerings?

b) How many rights are associated with one of the new shares?

c) Compute the theoretical value of right.

d) What is the ex-right price of stock?

e) Suppose your total assets consist of 500 shares of Roal Shoe Co. and cash Rs. 50,000. What is your wealth position before and after the right offering is you sell 200 rights and exercise 300 rights? (4x2.5+5=15)

Download in PDF | Fundamentals of Corporate Finance FIN-250 IV Year MGMT Question Paper 2077 BBS 4 Yrs Program Tribhuvan University (TU).

[alert type=alert_outline alert_info]Note :- If you need 2077/2020 Fundamentals of Corporate Finance (FIN-250) BBS IV Year Question paper in PDF File, please post your email address in "Comment Box" below. 😊[/alert]

[alert type=alert_outline alert_info]View the question paper of Fundamentals of Corporate Finance FIN-250 | BBS (Four Years Program) | IV Years | 2077-2020 | Bachelor Level | Tribhuvan University (TU).[/alert]

[buttonLink style=unelevated elcreative_ripple]Search Terms:[/buttonLink]

[alert type=alert_outline]Tribhuvan University (TU)., Fundamentals of Corporate Finance FIN-250 iv 4th year Question Paper 2077 BBS 4 Yrs Program TU., Bachelor Of Business Studies (BBS) IV Year Question Papers 2077., Exam Papers of BBS 4 Years Program IV Year MGMT 2077., TU BBS 4 Years Program IV Year MGMT 2077 Question Papers 2077-2020., BBS Mgmt IV Year Question Papers 2077-2020 MGT-221., Question Paper of Fundamentals of Corporate Finance FIN-250., Check Question Paper of Fundamentals of Corporate Finance FIN-250 2077., PDF Download Of Fundamentals of Corporate Finance FIN-250 2077., Check & Download Fundamentals of Corporate Finance FIN-250 2077-2020., Solution Of Question Paper Fundamentals of Corporate Finance FIN-250 2077., Exam Papers of BBS IV Year Fundamentals of Corporate Finance FIN-250 2077., Download 2076 Question Paper of Fundamentals of Corporate Finance FIN-250.[/alert]

Suggestions and/or questions are always welcome, either post them in the comment form or send me an email at drgurung82@gmail.com.

However, comments are always reviewed and it may take some time to appear. Always keep in mind "URL without nofollow tag" will consider as a spam. 😜