Fundamentals of Investment (FIN-253) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year | TU

| DOWNLOAD PDF | Bachelor Level | Fundamentals of Investment FIN-253 | Question Paper | 2076 | BBS 4 Years Program | IV Year MGMT| Tribhuvan University (TU).

Also Check:

Download PDF of Financial Institutions and Markets (FIN-252) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year.

Download PDF of Entrepreneurship & Enterprise Development (MGT-220) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year.

Download PDF of Fundamentals of Corporate Finance (FIN-250) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year.

Download PDF of Business Research Methods (MGT-221) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year.

Download PDF of Fundamentals of Investment (FIN-253) | Question Paper 2076 | BBS (4 Yrs. Prog.) | IV Year.

Group "A"

Brief Answer Questions:

Also Check:

Download PDF of Fundamentals of Investment (FIN-253) | IV Year | Question Paper 2077 | BBS (4 Yrs. Prog.) | TU.

1. List out the major characteristics of an investment.

2. State the roles of an investment banker.

3. Suppose short sell 400 shares for Rs. 150 per share and the initial margin requirement is 60 percent, how much in total deposit will you have in your short margin account?

4. Differentiate the price-weighed index from the value-weighed index.

5. Consider two investment alternatives: Stock X with 10 percent expected return and 20 percent standard deviation; and Stock Y with 15 percent expected return and 25 percent standard deviation. Which investment is better in terms of risk per unit of return?

6. State the major features of fixed income securities and describe any one of them.

7. Last year, ABC Company issued 8 percent coupon, 10 years maturity bond that was sold at per value of Rs. 1,000. This year, the market interest rates on similar risk class bonds have increased to 10 percent. What is the value of the bond today?

8. Nabil Equity Fund's net asset value per share is Rs. 20. If the fund's front-end load fee is 5 percent, what should be the offer price?

9. Assume that Portfolio A has Treynor's measure of 2.36 and that of the market is 3.10. Do you think that Portfolio A has outperformed the market? Why or why not?

10. How a call option is different from put option?

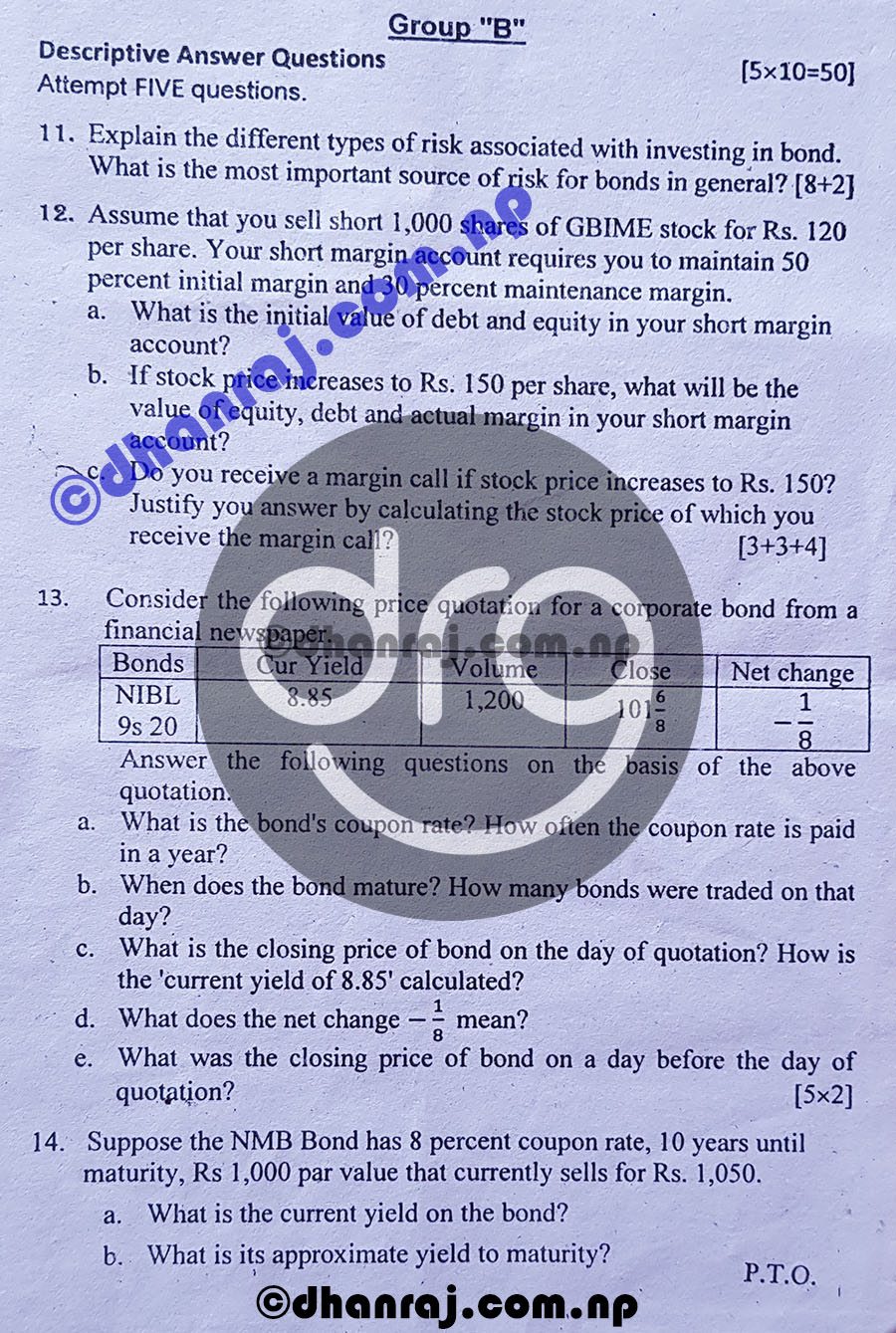

Group ''B''

Descriptive Answer Questions:

Attempt FIVE questions. [5x10=50]

11. Explain the different types of risk associated with investing in bond. What is the most important source of risk for bonds in general? [8+2=10]

12. Assume that you sell short 1,000 shares of GBIME stock for Rs. 120 per share. Your short margin account requires you to maintain 50 percent initial margin and 30 percent maintenance margin.

a) What is the initial value of debt and equity in your short margin account?

b) If stock price increases to Rs. 150 per share, what will be the value of equity, debt and actual margin in your short margin account?

c) Do you receive a margin call if stock price increases to Rs. 150? Justify your answer by calculating the stock price of which you receive the margin call? [3+3+4 =10]

13. Consider the following price quotation for a corporate bond from a financial newspaper.

| Bonds | Cur Yield | Volume | Close | Nate change |

|---|---|---|---|---|

| NIBL 9s 20 | 8.85 | 1,200 | 101 6∕8 | -1∕8 |

Answer the following questions on the basis of the above quotation.

a) What is the bond's coupon rate? How often the coupon rate is paid in a year?

b) When does the bond mature? How many bonds were traded on that day?

c) What is the closing price of bond on the day of quotation? How is the 'current yield of 8.85' calculated?

d) What does the net change -1/8 mean?

e) What was the closing price of bond on a day before the day of quotation? [5x2=10]

14. Suppose the NMB Bond has 8 percent coupon rate, 10 years until maturity, Rs. 1,000 per value that currently sells for Rs. 1,050.

a) What is the current yield on the bond?

b) What is it's approximately yield to maturity?

c) Assume that market interest rates declines to 6 percent in one year. What will be the rate of return if you buy the bond at current selling price today and sell the bond at the end of year 1? [2+4+4=10]

15. Assume that the risk-free rate is currently 7 percent. The accompanying table provides you the risk and return data for the ABC fund and the market portfolio during the year just ended.

| Data Item | ABC Fund | Market Portfolio |

|---|---|---|

| Rate of return | 13% | 11% |

| Standard deviation of return | 14% | 10% |

| Beta | 1.10 | 1.00 |

a) Calculate Sharpe's measure for the portfolio and the market. Compare the two measures, and assess the performance of the ABC fund during the year.

b) Calculate Treynor's measure for the portfolio and the market. Compare the two measures, and assess the performance of the ABC fund during the year.

c) Calculate Jensen's measure for the portfolio. Use it to assess the performance of the ABC Fund during the year. [3.5+3.5+3=10]

16. Hamro Lagani Kosh, a closed-end investment company, has a portfolio of assets worth Rs.1,000 million. It has liabilities of Rs.5 million and 50 million shares outstanding.

a) Calculate the fund's net asset value per share? What does it mean?

b) Assume that the fund trades at 10 percent discount from it's net asset value, what is the market price of the fund's shares?

c) Describe briefly the development of mutual funds in Nepal. [4+2+4=10]

Group "C"

Analytical Answer Questions: [2x15=30]

Attempt Any TWO questions.

17. What does a investment plan consist of? What are the steps involved in investing? How do the considerations about taxes, life cycle of investors and different economic environment affect investment?

18. Consider the following expected rates of return associated to three stocks: Stock A, Stock B and Stock C.

| Year | Rate of Return | ||

|---|---|---|---|

| Stock A | Stock B | Stock C | |

| 1 | 5% | 5% | 13% |

| 2 | 6 | 7 | 11 |

| 3 | 7 | 9 | 9 |

| 4 | 8 | 11 | 7 |

| 5 | 9 | 13 | 5 |

a) What are the average expected returns and standard deviation of returns for each of the three stocks?

b) If you form a portfolio comprising two-third investment in Stock A and one-third in Stock B, what are the expected return and standard deviation on your portfolio?

c) If you form a portfolio comprising two-third investment in Stock A and one-third in Stock C, what are the expected return and standard deviation on your portfolio?

d) What would you prefer the portfolio of Stock A and Stock B or the portfolio of Stock A and Stock C? Based on your calculations in part 'b' and 'c', what implications do you draw about the role of correlation with respect to portfolio risk and diversification? [4+4+4+3=15]

19. Assume that risk-free rate is currently 5 percent, which is expected remain at the same level for foreseeable future. The rate of return on average stock in the market is 15 percent. You are evaluating the prospects of investing in HPC stock which is currently paying Rs 10 per share in dividend. The stock has a beta coefficient of 1. Your analysis has revealed that new production system and aggressive marketing campaign launched by the company will boost up it's earning significantly. As a result, the dividend on this stock is expected to grow at 20 percent for the coming two years. After this period, the growth rate is expected to slow down to a normal level of 5 percent, indefinitely.

a) What is the required rate of return on HPC stock?

b) What is the expected dividend per share on HPC stock for next two years.

c) At what price the stock is expected to sell at the end of year 2?

d) What is the fair value of this stock today?

e) If the stock is currently trading at Rs. 130 per share, would you prefer to buy the stock? Explain. [2+2+4+5+2=15]

[alert type=alert_outline alert_info]Note :- If you need 2076/2019 Fundamentals of Investment (FIN-253) BBS IV Year Question paper in PDF File, please post your email address in "Comment Box" below. 😊[/alert]

[alert type=alert_outline alert_info]View the question paper of Fundamentals of Investment (FIN-253) | BBS (Four Years Program) | IV Years | Bachelor Level | Tribhuvan University (TU).[/alert]

[buttonLink style=unelevated elcreative_ripple]Search Terms:[/buttonLink]

[alert type=alert_info]Tribhuvan University (TU), Fundamentals of Investment FIN-253, BBS 4th Year Question Papers 2076-2019, Bachelor Of Business Studies (BBS) IV Year Question Papers 2076, Exam Papers of BBS 4 Years Program IV Year MGMT 2076, TU BBS 4 Years Program IV Year MGMT 2076 Question Papers 2076-2019, BBS Mgmt IV Year Question Papers 2076-2019 MGT-221, Question Paper of Fundamentals of Investment FIN-253, Check Question Paper of Fundamentals of Investment FIN-253 2076, PDF Download Of Fundamentals of Investment FIN-253 2076, Check & Download Fundamentals of Investment FIN-253 2076-2019, Solution Of Question Paper Fundamentals of Investment FIN-253 2076, Exam Papers of BBS IV Year Fundamentals of Investment FIN-253 2076, Download 2076 Question Paper of Fundamentals of Investment FIN-253.[/alert]

Suggestions and/or questions are always welcome, either post them in the comment form or send me an email at drgurung82@gmail.com.

However, comments are always reviewed and it may take some time to appear. Always keep in mind "URL without nofollow tag" will consider as a spam. 😜